European Aftermarket today and tomorrow

On 3. November 2023, the summit of the automotive industry in Poland - the 18th Automotive Industry and Market Congress organised by the Association of Automotive Distributors and Manufacturers (SDCM) - took place at the Sound Garden Hotel in Warsaw. One of the speakers was Matthieu Simon representing the Roland Berger consulting firm. He spoke on the outlook for the European aftermarket.

Overview of the European automotive aftermarket

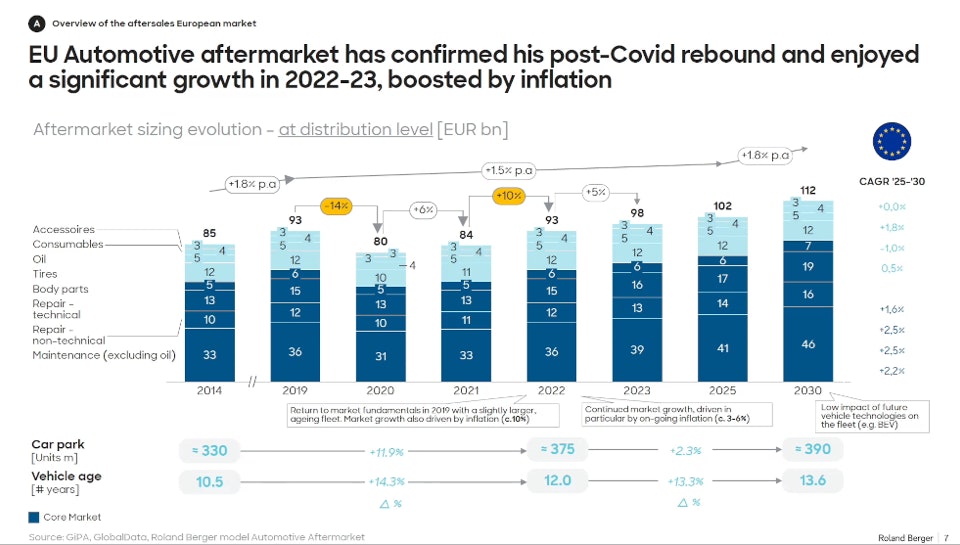

In the past few years, two events have had the greatest impact on many global markets: the coronavirus pandemic and the war in Ukraine. Both events have also left a strong mark on the automotive industry including the aftermarket.

- 2020, the year of the pandemic, was the first year in the history of the automotive aftermarket in which no growth was recorded. That was due to reduced average annual mileage of cars. The market has already returned to pre-pandemic levels in 2022 and is continuing to grow this year. This is influenced in part by inflation, but also by an ageing car fleet across Europe. - Matthieu Simon said.

The current increase in the price of new cars is having a significant impact on the ageing of the car fleet in south-west Europe. Matthieu Simon, taking France as an example, pointed out that the average age of a car before the pandemic was somewhere around 10 years, while in the current year, the average age of a car in France is already around 12 years.

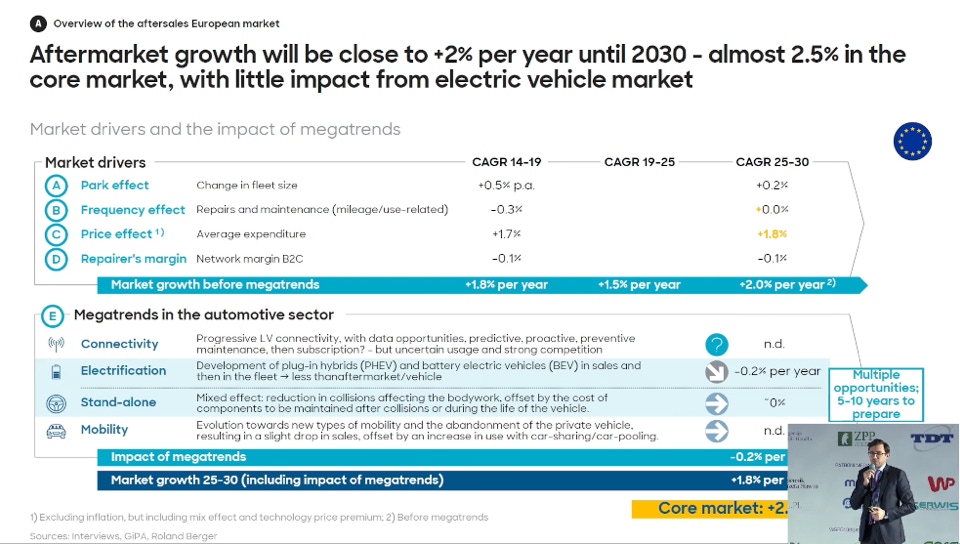

- Although the electrification of road transport is likely to cause declines in the aftermarket, we do not expect this to happen yet this decade. With high new car prices followed by declining car sales, the impact of BEVs on the aftermarket will be marginal by 2030, Simon said.

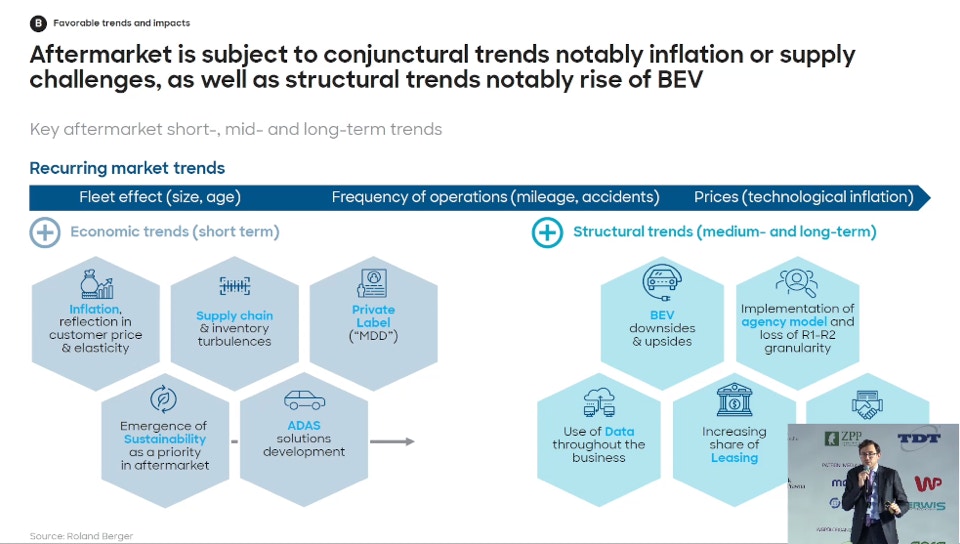

In the presentation, the influences on the automotive aftermarket are divided into two categories. The first is economic trends that will affect the market in the short term. In the medium to long term, on the other hand, structural issues will have a greater impact on the market, such as: the increasing popularity of long-term rental or the increasing market share of electric cars.

- One short-term factor that will have an economic impact on the aftermarket in the near run is the move towards sustainability. Up until five years ago, this was not talked about either in discussions with customers or at various conferences. The topic simply did not exist. Today, sustainability is a reality to which participants in the automotive aftermarket must adapt.

- Long-term rental, which is becoming increasingly popular, could also become a major threat to the independent aftermarket in the future. Car manufacturing concerns are already starting to introduce the option of leasing a car for 10 years, for example. During this time, they will own the car and therefore decide how it is repaired. This will enable these companies to build their own 'slice of the aftermarket' in which they will each have a 100% stake.

Competitiveness and possible scenarios

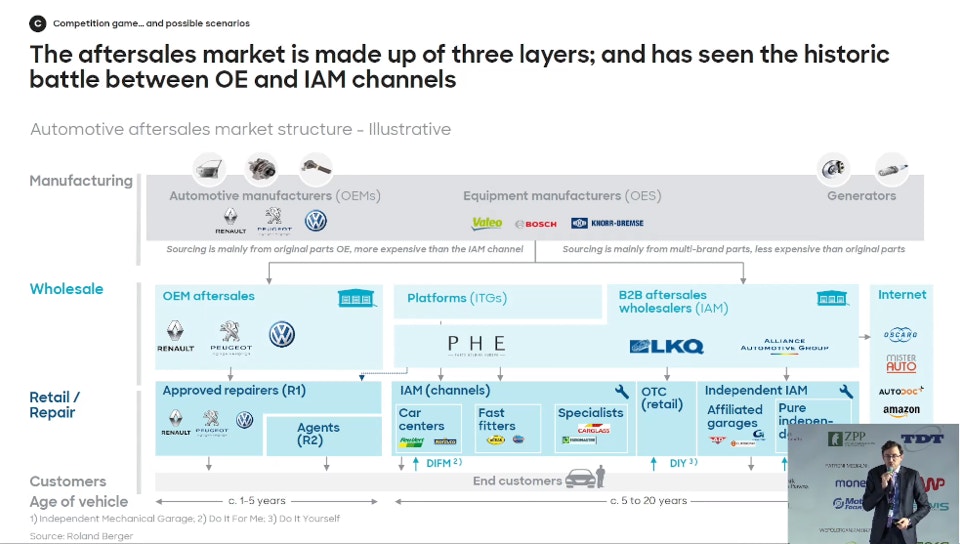

In his presentation, Matthieu Simon singled out three areas of competition in the automotive market. At the highest level the competition is between parts manufacturers, a level below that are wholesalers and in the last area he placed local distributors.

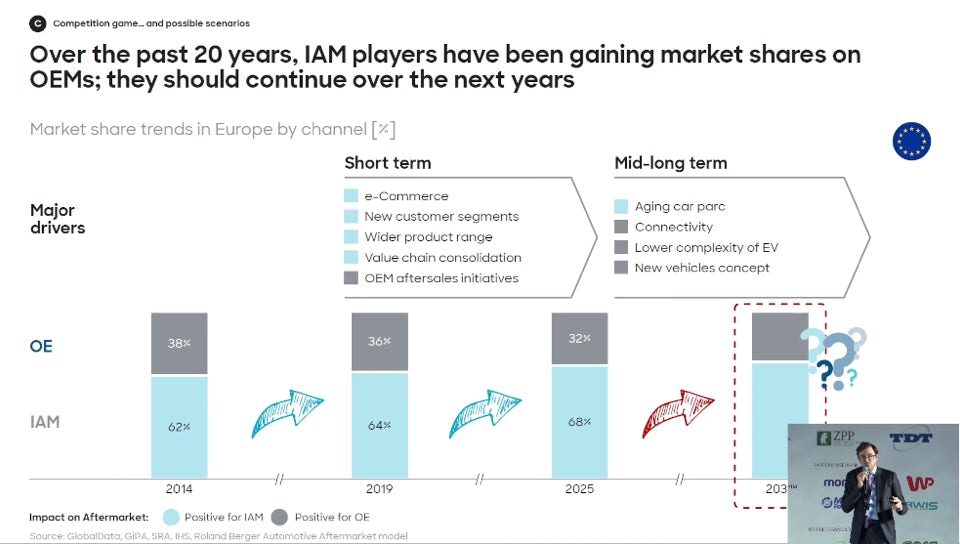

- Over the past decades, we have seen a regular growth of the independent aftermarket at the expense of OEM parts. This has been influenced, among other things, by phenomena such as the ageing vehicle fleet and the systematic improvement in the quality of alternative parts. We expect IAM to continue to grow until at least 2035, mainly due to the ageing European vehicle fleet.

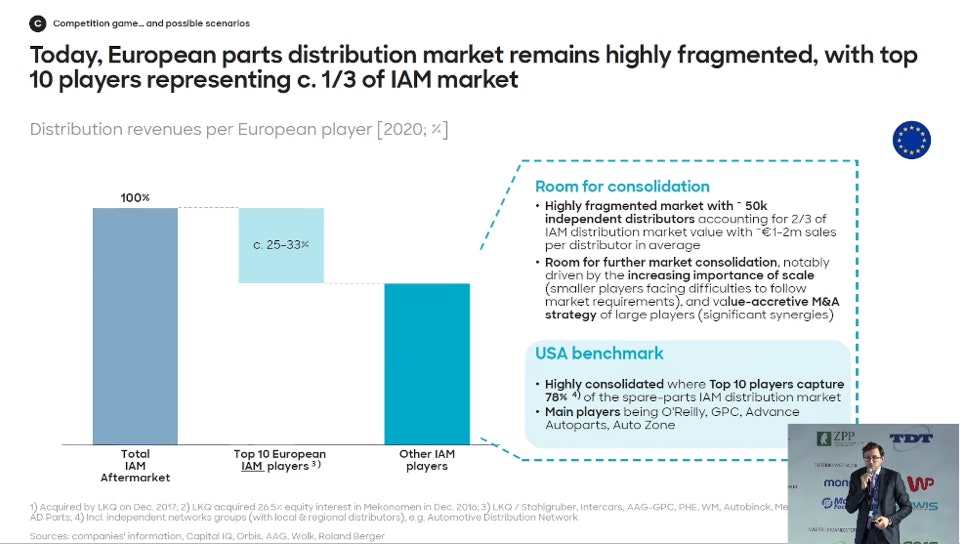

The expert also pointed out that there is still a lot of room for consolidation in the independent market, as the 10 largest distributors only hold 1/3 of the market. According to his predictions, consolidation in the market is even a certain scenario. He believes that smaller distributors will not have the capacity to match the growing demands of the market

A video recording of the session