Forecast on independent market in 2023

In recent years, making any predictions about the situation of the automotive market has become considerably more difficult. Giving an answer to the question: "What is coming in 2023?" we could start with the words: "If no disaster happens...".

The crisis we are currently experiencing in Europe is of course translating into the functioning of the entire automotive industry. Persistent inflation means that manufacturers and distributors of parts in the aftermarket need to make further price adjustments.

At the 17th Automotive Industry and Market Congress, organised by SDCM at the end of 2022, manufacturers indicated that their biggest concerns for the new year are increases in raw material and energy prices. Distributors of parts add to this the increase in logistics costs and parts prices, and automotive garages, due to rising business costs, will be forced to raise prices for their services. Today, it is difficult to predict where the changes we are seeing will lead and when the process of change will end.

Below we present selected data on the automotive industry. The full report prepared by Santander Bank Polska in cooperation with MotoFocus.pl can be downloaded from here.

IAM and OE parts manufacturers

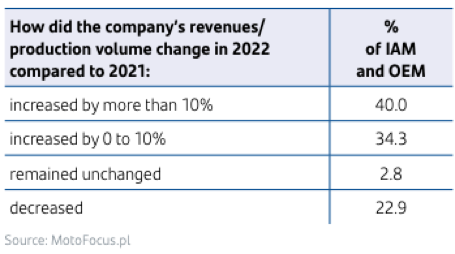

In 2022, production of automotive parts was better than in the previous year. The trend was in line with the growth of the volume of spare parts trade in the EU (+3%), as well as the growth of passenger vehicle production in the main countries in the EU, i.e. Germany (+11%), the Czech Republic (+10%) and Spain (+7%). Almost three-quarters of the respondents reported an increase in production compared to the previous year.

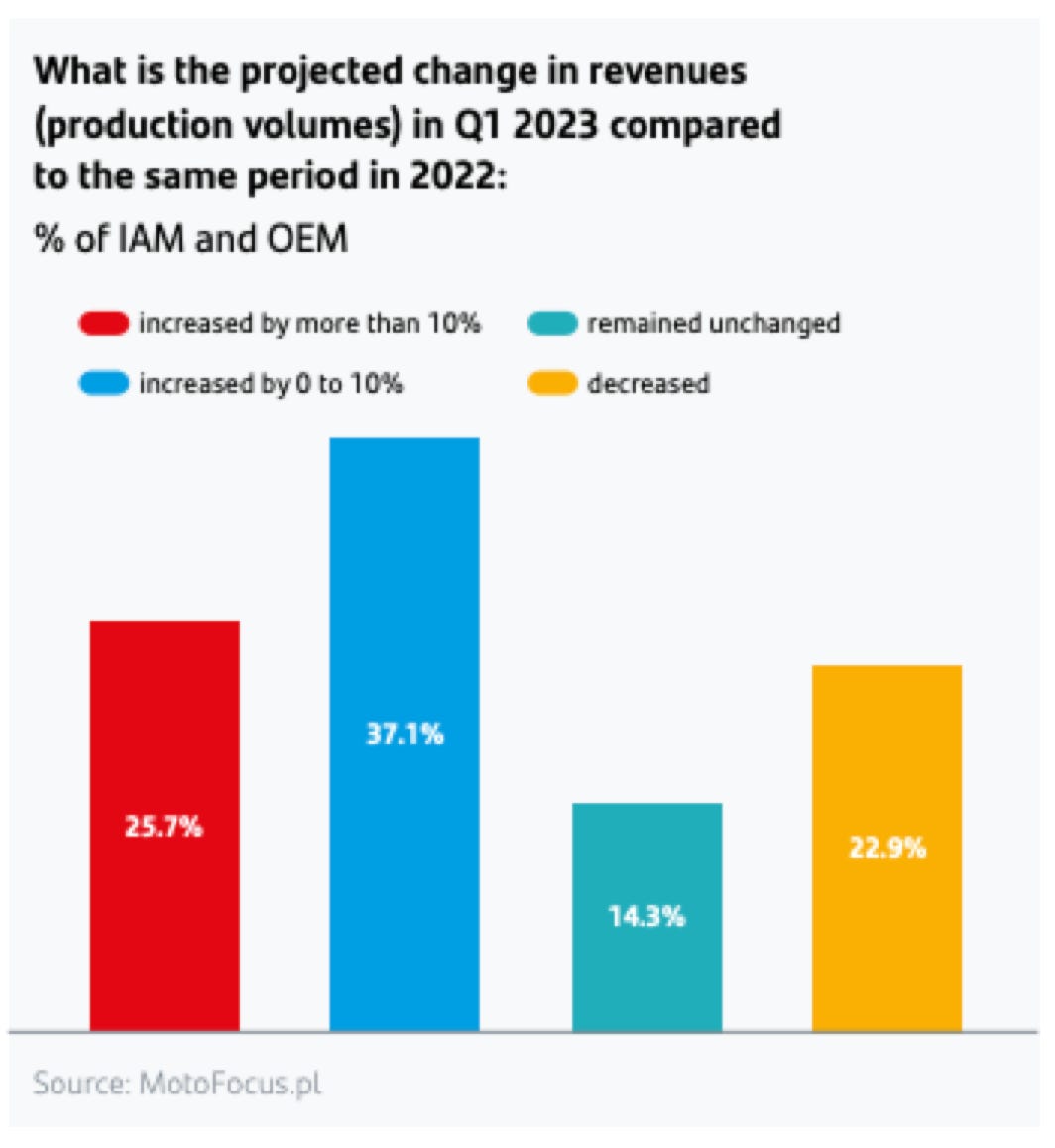

Manufacturers mostly claim that the upward trend will be continued in the first quarter of 2023. Admittedly, year-on-year declines are expected by more than a fifth of respondents, which is virtually identical to the responses to the previous question. At the same time, the number of companies counting only on maintaining current values has increased. More than 60% of respondents, on the other hand, expect increases in production volumes and revenues.

Much worse in the manufacturers' forecasts for 2023 is the issue of profitability. It was already a major problem for companies in 2022. At that time, it not only declined compared to 2021, but was significantly lower compared to 2018-2019 levels. Currently, only a third of respondents expect increases. Almost half of the automotive parts manufacturers, on the other hand, fear a decline in profitability. We might forecast that without industry-dedicated public support programmes, while imposing more and more obligations and targets for the industry to meet, manufacturers' profitability could decline further.

Automotive Spare Parts Distributors

Both the 2009 crisis and the pandemic crisis have shown that the aftermarket is then doing better.

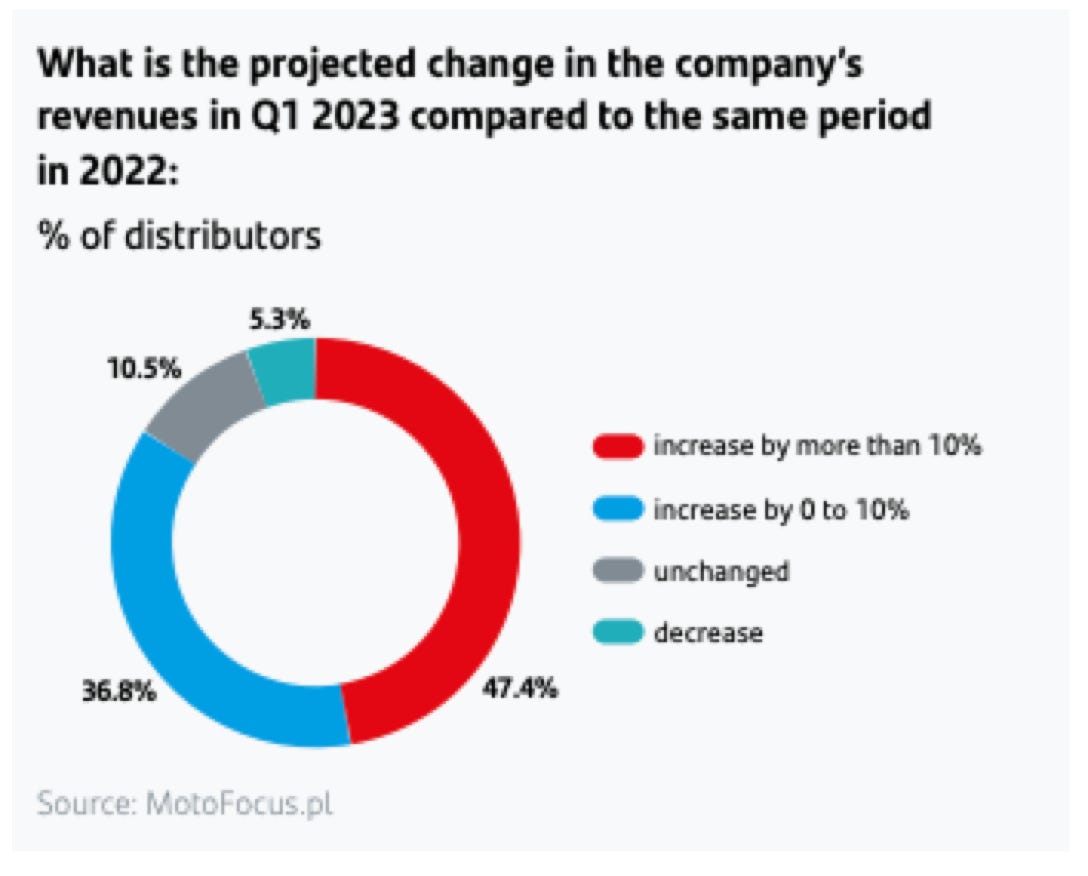

The good annual performance of parts distributors is therefore not surprising. The vast majority of the distributors surveyed (84.2%) recorded increases in revenue compared to 2021, with 68.4% of those surveyed recording increases of more than 10%. Few segments of the economy can currently boast similar results.

The same number of companies expect further increases in Q1. 2023 compared to the same period a year before.

There are two parts distributors on the Polish market that are also listed companies, which obliges them to publish their financial results. We are, of course, referring to Inter Cars SA and Auto Partner SA.

Both Inter Cars and Auto Partner have already published their sales reports for the first quarter and both companies recorded sales increases of almost 30%. Inter Cars increased sales revenue by 29% (sales revenue including foreign daughter companies amounted to PLN 4 bn 088.1 million - report), and Auto Partner by 30.7% (sales revenues including foreign daughter companies amounted to PLN 836.3 million - report).

Automotive garages

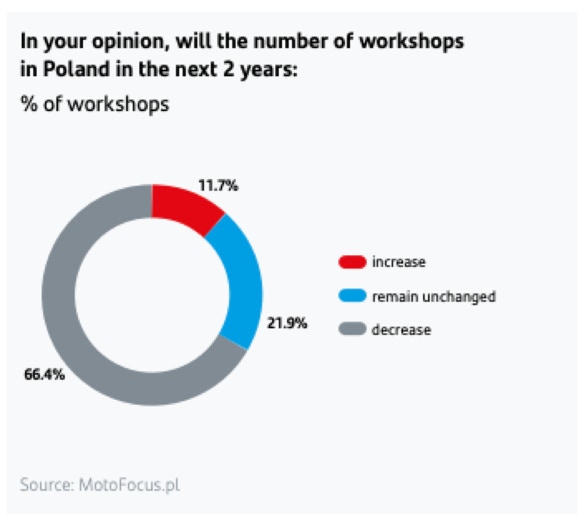

It seems that the current situation of automotive garages is stable. However, in the next few years the market is going to undergo quite a revolution, compounded by the difficult situation in the economy. That is why the MotoFocus.pl survey included a question about whether the number of garages will increase or decrease over the next two years. It turned out that, according to as many as two-thirds of those surveyed, there will be fewer and fewer garages on the market.

The full report contains much more data summarising the past year in the automotive industry and forecasts for the current 2023. We encourage you to download the full version of the publication free of charge: