Automotive industry after Q2 2023

In recent months, the automotive industry has seen some stabilization after the upheaval caused by the outbreak of the coronavirus pandemic or the war in Ukraine. However, the market still faces many challenges. The current situation of the industry is presented in the latest report after Q2 2023, prepared by MotoFocus.pl in cooperation with Santander Bank Poland and the Polish Investment and Trade Agency.

Automotive parts distributors

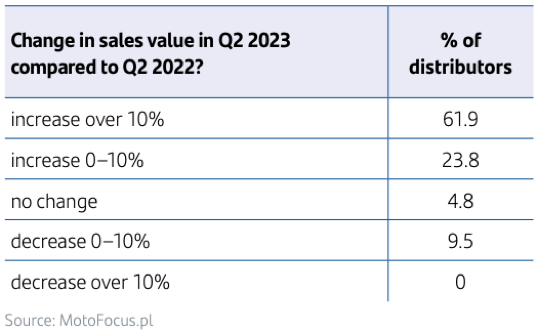

Among the auto parts distributors surveyed, more than 80 per cent were those specialising in the sale of parts for passenger cars, with the remaining less than 20 per cent serving primarily the heavy-duty segment. In Q2 2023, distributors once again recorded impressive results. Almost two-thirds of the respondents recorded sales growth of more than 10%. Declines (never exceeding 10%) were reported by less than 10%. Worth noting is that the increases were significantly higher than the forecasts from the previous quarter (when only 66.7% of survey participants expected growths).

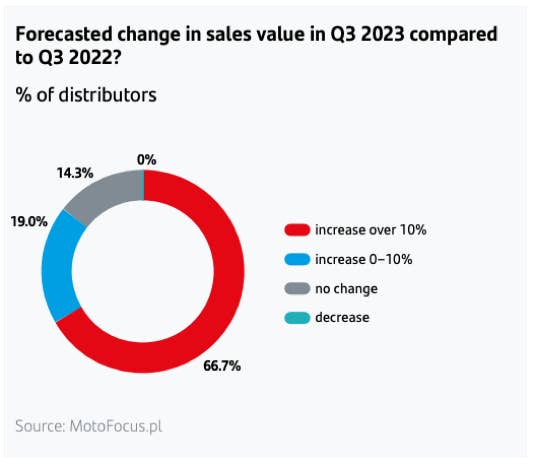

The distributors’ forecasts for the change in sales values in the next quarter are also very optimistic. The vast majority expect increases, and increases of more than 10%. Noteworthy is also the lack of companies that forecast a decrease in the value of sales.

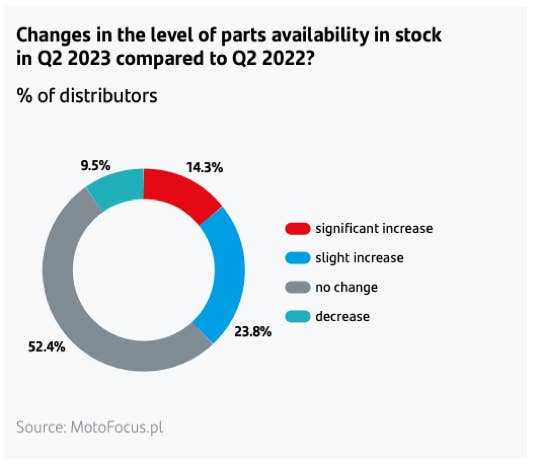

In previous quarters, lower parts availability due to disrupted supply chains has been one of significant problems. An increased year-on-year level of availability in Q2 was reported by 38% of respondents. In contrast, more than half saw no change in this area. However, the parts availability issues observed particularly in 2020 and 2021 appear to have been significantly reduced and we are no longer seeing shortages such as during the coronavirus pandemic. Drivers leaving their cars for repair at workshops have a choice of parts from different suppliers and in different price ranges.

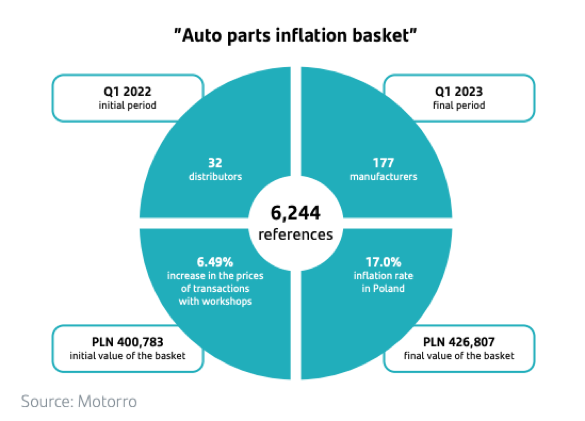

Motorro’s survey of the automotive parts inflation basket shows that the year-on-year increase in wholesaler’s prices in Q1 2023 was 6.49%. The net value of the basket based on wholesale prices in transactions with workshops from almost all importers/distributors was PLN 400,783 in Q1 2022, and a year later the same basket was already worth PLN 426,807. This increase, which is rather small in relation to inflation in Poland, can only be explained partly by the incomplete passing on of costs to customers, as the profitability of distributors at that time did fall, but only marginally. Thus, the main reason seems to be a slight increase in the purchase prices of goods, which in turn is explained to a large extent by the low change dynamics of many production costs of parts manufacturers. As a reminder, in Q1 2022, the prices of at least some raw materials soared after the outbreak of the war in Ukraine, and were falling down in subsequent quarters.

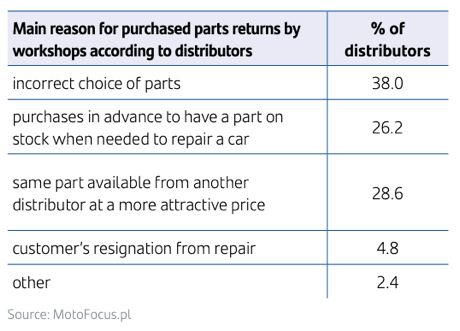

One of the challenging tasks facing parts distributors is the handling of returns. Proper diagnosis of the causes helps to significantly reduce the associated costs. We asked distributors about the main reasons for returns made by workshops. The largest number of respondents pointed to the wrong choice of parts. This is not due to the lack of knowledge on the part of mechanics, but increasingly often due to the constraints imposed by car manufacturers. Problems with obtaining precise information on the parts used in a particular vehicle model are still a major concern for the industry. Unfortunately, without improved cooperation with car manufacturers, this problem will continue to be significant. The answer concerning price competition among distributors scored only slightly lower.

Independent automotive workshops

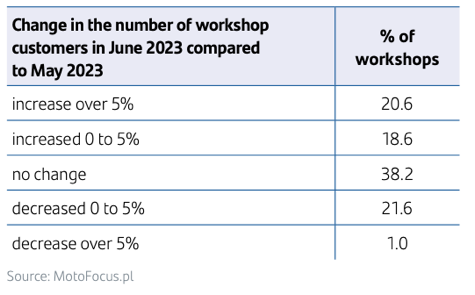

On a month-on-month basis, there has been a slight increase in the number of customers in workshops. Around 40% saw an increase and one in five reported a decrease. However, the increase in the number of customers in June may be mainly of seasonal nature and related to the higher number of diagnostics and repairs before the holiday and summer season.

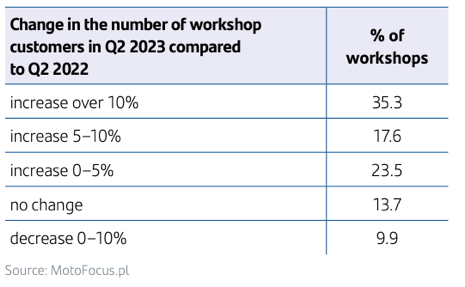

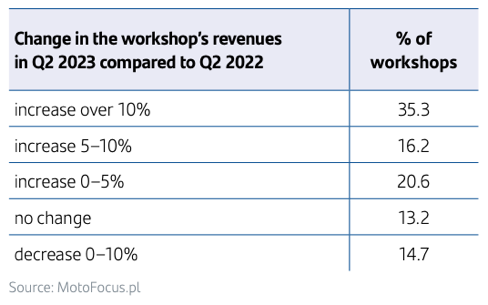

Just like in previous years, workshops where asked about the change in the number of customers and the year-on-year change in revenue. More than half of the respondents reported increases in both cases and around a quarter reported decreases. When comparing the two statements, a high correlation is apparent. However, it is difficult to conclude to what extent higher revenues are due to an increase in the number of clients and to what extent to an increase in the prices of services.

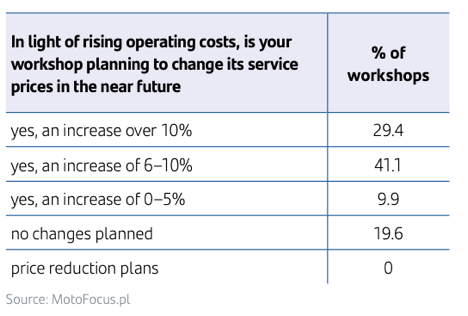

In addition to the recorded increase in revenue and customer numbers, costs are also rising, effectively eroding the profits made. The vast majority of workshops are therefore planning to increase their service prices in the near future, with over 70% intending to raise them by more than 5%.

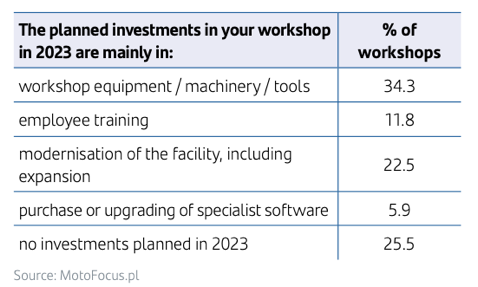

We also asked workshops about planned investments. Almost three quarters of those surveyed have taken steps to invest and are betting on expansion this year. The largest group points to equipment, machinery and tools as the main target for investment, while a slightly smaller group intends to modernise or expand their facilities, in part precisely for the purpose of locating new equipment there. There is far less interest in other types of investment. 25% of workshops have no plans to invest in 2023. Rapidly rising costs and a lack of funds are probably the main factors here, but this may prove to be a vicious circle. A lack of investment and a loss of competitiveness against workshops that have set their sights on growth could lead to a decrease in customers and profits and consequently to the further worsening of the financial situation.

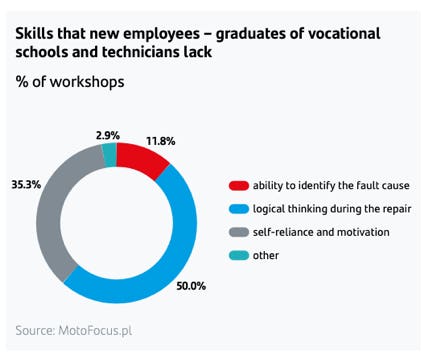

An efficient system of training at vocational schools and automotive technical colleges is needed to ensure a supply of qualified staff to service vehicles. We asked the workshops what skills new employees - graduates of such schools - lack. The results confirm the general complaints about the education system. The respondents mainly pointed to problems in the areas of logical thinking, self-reliance and motivation. The work of a mechanic in many cases requires analytical thinking, which is essential for the correct identification of a fault during repair. It is important to realise that a small error during a repair can ultimately lead to further damage and thus to complaints and a loss of the workshop reputation.